Bitcoin, the pioneering cryptocurrency, has captured the attention of investors, technologists, and financial analysts since its inception in 2009. As the first decentralized digital currency, it introduced a revolutionary concept of peer-to-peer transactions without the need for intermediaries. Over the years, Bitcoin has experienced significant price fluctuations, often characterized by dramatic surges and steep declines.

This volatility has led to a burgeoning interest in Bitcoin price prediction, as stakeholders seek to understand the factors that drive its value and anticipate future movements. The allure of Bitcoin price prediction lies not only in the potential for profit but also in the broader implications for the financial landscape. As traditional financial systems grapple with the rise of digital currencies, understanding Bitcoin’s price dynamics becomes crucial for both individual investors and institutional players.

Various methodologies, including fundamental analysis, technical analysis, and sentiment analysis, are employed to forecast Bitcoin’s price trajectory. Curious about where Bitcoin is headed next? Get the latest bitcoin price prediction and stay ahead of the market. MEXC offers detailed analysis that helps both beginners and experienced traders forecast potential price movements. Don’t rely on guesses—use real data and insights to guide your strategy.

Factors Influencing the Bullish Trend

Several factors contribute to the bullish trend observed in Bitcoin’s price over recent years. One of the most significant drivers is the increasing institutional adoption of cryptocurrencies. Major financial institutions, hedge funds, and publicly traded companies have begun to allocate portions of their portfolios to Bitcoin, viewing it as a hedge against inflation and a store of value akin to gold.

For instance, companies like MicroStrategy and Tesla have made substantial investments in Bitcoin, signaling a shift in perception from a speculative asset to a legitimate investment vehicle. This institutional interest not only provides liquidity to the market but also enhances Bitcoin’s credibility among retail investors. Another critical factor influencing Bitcoin’s bullish trend is the macroeconomic environment characterized by low-interest rates and expansive monetary policies.

Central banks around the world have implemented unprecedented measures to stimulate their economies in response to crises such as the COVID-19 pandemic. These policies have led to concerns about inflation and currency devaluation, prompting investors to seek alternative assets that can preserve value over time. Bitcoin, with its capped supply of 21 million coins, is often viewed as a deflationary asset that can withstand inflationary pressures.

This perception has fueled demand and contributed to upward price momentum.

Technical Analysis of Bitcoin Price

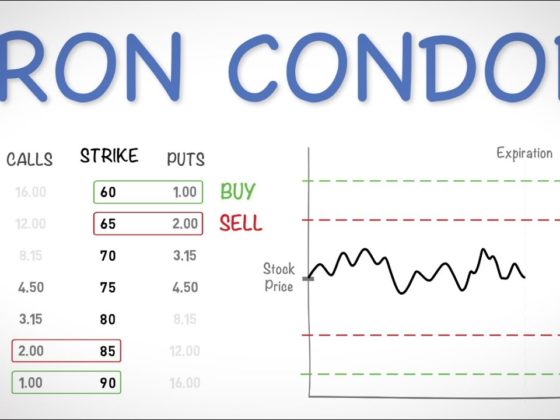

Technical analysis plays a pivotal role in understanding Bitcoin’s price movements and predicting future trends. Traders and analysts utilize various charting techniques and indicators to identify patterns and potential entry or exit points. One commonly used tool is the Moving Average (MA), which smooths out price data over a specified period to identify trends.

For example, the 50-day and 200-day moving averages are frequently monitored by traders to gauge market sentiment. When the short-term moving average crosses above the long-term moving average—a phenomenon known as a “golden cross”—it often signals a bullish trend, while the opposite scenario, known as a “death cross,” may indicate bearish sentiment. In addition to moving averages, other technical indicators such as Relative Strength Index (RSI) and Fibonacci retracement levels are employed to assess market conditions.

The RSI measures the speed and change of price movements, helping traders identify overbought or oversold conditions. A reading above 70 typically indicates that an asset may be overbought, while a reading below 30 suggests it may be oversold. Fibonacci retracement levels, derived from the Fibonacci sequence, are used to identify potential support and resistance levels based on historical price movements.

By combining these tools, traders can develop a more nuanced understanding of Bitcoin’s price action and make informed decisions based on market trends.

Expert Opinions and Market Sentiment

Expert opinions on Bitcoin’s future price trajectory vary widely, reflecting the diverse perspectives within the cryptocurrency community and financial markets at large. Some analysts remain bullish, citing factors such as increasing adoption rates, technological advancements in blockchain technology, and the potential for Bitcoin to become a global reserve currency. Prominent figures like Cathie Wood of ARK Invest have predicted that Bitcoin could reach astronomical prices in the coming years as institutional adoption continues to grow and regulatory clarity improves.

Conversely, there are skeptics who caution against overexuberance in the market. Critics often point to historical price bubbles and subsequent crashes as evidence of Bitcoin’s speculative nature. They argue that while Bitcoin may have potential as a digital asset, its volatility poses significant risks for investors.

Additionally, regulatory scrutiny from governments around the world could impact market dynamics. For instance, China’s crackdown on cryptocurrency mining and trading has raised concerns about potential regulatory actions in other jurisdictions, which could lead to increased volatility and uncertainty in Bitcoin’s price. Market sentiment also plays a crucial role in shaping Bitcoin’s price movements.

Social media platforms, forums, and news outlets contribute to the collective sentiment surrounding Bitcoin, influencing investor behavior. Positive news coverage or endorsements from influential figures can lead to surges in buying activity, while negative news can trigger panic selling. The rise of social media platforms like Twitter and Reddit has amplified this phenomenon, with communities rallying around specific narratives that can drive short-term price fluctuations.

Potential Challenges and Risks

Despite its bullish outlook, Bitcoin faces several challenges and risks that could impact its price trajectory. One significant concern is regulatory uncertainty. Governments around the world are grappling with how to regulate cryptocurrencies effectively while balancing innovation with consumer protection.

Stricter regulations could hinder market growth or lead to increased compliance costs for businesses operating in the cryptocurrency space. For example, proposals for stricter Know Your Customer (KYC) regulations could limit anonymity features that many users value in cryptocurrencies. Another challenge is technological vulnerabilities that could undermine confidence in Bitcoin as a secure asset.

While the Bitcoin network itself has proven resilient against attacks over the years, vulnerabilities in exchanges or wallets can lead to significant losses for investors. High-profile hacks have resulted in millions of dollars worth of Bitcoin being stolen from exchanges, raising concerns about security practices within the industry. Additionally, scalability issues pose challenges for Bitcoin’s ability to handle increased transaction volumes as adoption grows.

Solutions such as the Lightning Network aim to address these concerns by enabling faster transactions at lower costs; however, widespread implementation remains a work in progress. Market volatility is another inherent risk associated with investing in Bitcoin. The cryptocurrency market is known for its rapid price swings driven by various factors such as market sentiment, macroeconomic events, or technological developments.

Investors must be prepared for potential downturns and should consider their risk tolerance before entering the market. The psychological aspect of trading can also lead to irrational decision-making during periods of extreme volatility, further exacerbating price fluctuations.

Conclusion and Key Takeaways

Understanding Market Dynamics

As stakeholders monitor market developments and adapt their approaches, it is clear that Bitcoin will be a key topic in discussions about the future of finance. The interplay between innovation, regulation, and market sentiment will ultimately determine how Bitcoin evolves as an asset class and its role within the broader financial ecosystem.

Navigating the Dynamic Market Landscape

Investors must remain informed and vigilant as they engage with this dynamic market landscape. By doing so, they can make informed decisions and navigate the complexities of Bitcoin.

The Future of Bitcoin and Finance

Ultimately, the future of Bitcoin and its role in finance will depend on the interplay between innovation, regulation, and market sentiment. As the market continues to evolve, investors must stay informed to make the most of this dynamic landscape.