If you’re a day trader or investor looking to make the most of your investments, you’ve probably heard of or researched the Elliott Wave Theory. This trading theory offers an excellent way to identify patterns in stock markets and predict future trends – but many struggles with understanding how it works.

In this article, we’ll look at the Elliott Wave Theory, its components, terminology, and calculation rules. You’ll even find out why some investors consider this approach so valuable and learn proven strategies that use this powerful tool to potentially maximize profits.

What is the Elliott Wave Theory in trading, and how does it work

The Elliott Wave Theory has been a popular trading tool for decades. It was developed by Ralph Elliott in the 1930s and has since become an industry mainstay. The theory includes the idea that the markets are always ‘rational’, meaning that when prices move, they reflect the underlying psychological sentiment of investment sentiment – optimism or pessimism. In other words, investors look at market patterns to predict future price movements with the help of the Elliott Wave Theory.

At its core, it involves looking at historical data and current market trends to identify upswings and downswings to plot out five large waves that investors can use to predict future highs and lows to gain an edge over other investors. Thus, this strategy provides a comprehensive view of the markets traders can use to make informed decisions about entering or exiting positions.

While this time-tested theory will never guarantee consistent results due to the ever-changing market sentiments and unpredictable news events, it does give experienced traders an insight into potential future market movements for both short-term trading and long-term investing.

The five waves of the Elliott Wave Theory

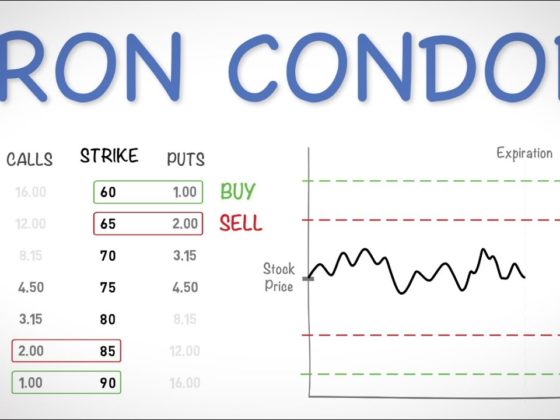

Every wave of the Elliott Wave Theory consists of five sub-waves. However, not all waves will look the same – depending on the market context and conditions, some waves can form in different shapes. Each wave is given a specific name to help traders distinguish them:

Impulse Waves: The initial three waves are called impulse waves, which move in the direction of the primary trend (up or down). It is also known as ‘directional momentum’ and suggests that price movements have strength behind them.

Corrective Waves: The fourth wave forms against the overall trend, opposite waves one and two. This wave is known as corrective and serves to counterbalance any overshoots or unexpected changes in the price.

The fifth wave: The final wave is the ‘terminal wave’, typically the most extended, vital wave. This wave often marks a reversal point, either by continuing in the same direction as previous waves (an extension) or reversing back against the trend (a retracement).

How to use the Elliott Wave Theory to set up trades

Now that you understand the Elliott Wave Theory’s basic structure let’s look at how you can use it to set up trades.

First and foremost, you must identify the starting point of your wave – which is usually a prominent peak or trough in prices. Once this has been determined, you can start counting each wave’s highs, lows, and lengths. By comparing different waves against one another, experienced traders can gain insight into potential future market movements.

From here, traders should determine whether to enter a long position (buy stocks) when they expect the market to move higher or open a short position (sell stocks) when they expect the market to go lower. They can also monitor current wave patterns to decide when they should exit their positions and take any profits.

Of course, the Elliott Wave Theory is not fool-proof – market conditions are constantly changing, so traders must keep up with the news and economic data and understand how stock trading works to optimize their trades.

Pros of the Elliott Wave Theory

Using the Elliott Wave Theory provides a comprehensive view of stocks trading and offers traders many advantages:

The main benefit is that it helps traders to identify potential market reversals before they happen, which can be highly beneficial when entering or exiting positions.

The theory also provides insight into the strength of price movements, meaning traders can make more informed decisions about their trades. Experienced traders can likely find profit opportunities relatively quickly, even in a volatile market.

Finally, using the Elliott Wave Theory does not require any particularly sophisticated tools. Instead, it relies on traditional technical analysis techniques such as trendlines and chart patterns to provide insight into future market movement. It makes it an accessible strategy for all levels of traders.